本帖最后由 子曰汉硕刘老师 于 2021-8-15 14:36 编辑

疫情下濒临崩溃的石油帝国(下)

The alliance is shaky. Russia, the world’s second-biggest producer, has worked with OPEC since 2016 but routinely ignored the terms of deals. It is unlikely that America will permanently join OPEC in creating a new energy order. The new pact involves assurances that output will fall in America but Texan frackers respond to price signals and the profit motive, not government quotas. The deal almost fell apart when Mexico refused Saudi Arabia’s terms, illustrating how one country can prompt an unravelling. And Saudi Arabia continues to offer deep discounts on crude bound for Asia, a sign of its eagerness to defend its powerful position in oil’s most important market.

该联盟也摇摇欲坠。全球第二大石油产国俄罗斯自2016年以来一直与OPEC合作,但经常无视协议条款。美国不太可能永久加入OPEC来建立新的能源秩序。新协议保证美国的产量将会下降,但德州佬们只对价格信号和利润动机做出反应,而非政府配额。当墨西哥拒绝沙特阿拉伯的条件时,该协议几乎破裂,这也显示了一个国家如何就能够促使该协议作废。与此同时,沙特阿拉伯继续大幅打折向亚洲出口原油,这是一个信号,表明该国迫切希望捍卫自己在这个石油最重要市场的强大地位。

A last reason for scepticism is that the covid-19 crisis could further dampen long-term oil demand. Hundreds of millions of people are living through an experiment with home-working, fewer flights and less urban pollution. This could help change public opinion about the desirability of a faster shift from an economy built on fossil fuels.

最不值得怀疑的一个原因是,“新冠病毒”危机可能会进一步抑制长期的石油需求。数以亿计的人正在家工作、机场航班减少和城市污染也得到了改善。这可能有助于改变公众希望依赖于化石燃料的经济快速转型的看法。

Rather than stability, then, oil producers face volatile demand and production. Iran and Venezuela, already squeezed by American sanctions, will see more unrest. Countries with high costs and poor governance, such as Nigeria and Angola, face capital flight and balance-of-payments crises. Last year bankruptcies among American oil producers jumped by 50%. In 2020 that figure will soar.

因此,石油生产国面临的是不稳定的需求和产量。已经受到美国制裁打击的伊朗和委内瑞拉将会出现更多的动荡。高成本和治理不善的国家,如尼日利亚和安哥拉,面临资本外逃和收支平衡危机。去年,美国石油生产商的破产数量激增了50%。到2020年,这个数字将会飙至更高。

Beyond this year a deeper adjustment awaits. Volatility will dampen investors’ appetite for new projects. Oil companies have already slashed capital spending by about 25% this year. Some pricey oil will be left underground for good. Shale’s frenetic growth will abate. Big oil exporters, including Saudi Arabia, will have to cut public spending and diversify.

今年之后,还需要进行更深层次的调整。波动性将抑制投资者对新项目的兴趣。石油公司今年已经削减了25%的资本支出。一些昂贵的石油将留在地下,不被开采。页岩气的疯狂增长将会减弱。包括沙特阿拉伯在内的大型石油出口国将不得不削减公共开支并实现多样化经营。

For years the oil industry has faced the possibility that demand might fall, as governments moved to limit climate change. That threatened to heap chaos on oil producers, as capital dried up and companies battled for their share of a dwindling market. A peak in demand may still be years away. But oil producers should see covid-19’s turmoil for what it is: not an aberration, but a sign of what is to come.

多年来,随着各国政府采取措施应对气候变化,石油行业一直面临需求下降的可能性。随着资本枯竭,企业在不断萎缩的市场中争夺自己的份额,这些措施可能会给石油生产商带来混乱。石油需求达到峰值可能还需要数年时间。但石油生产国应该认清“新冠疫情”带来的动荡:这不是一种反常现象,而是未来的一种常态。

词汇积累

1. ignore v. 忽视,不理睬 2. permanently 英 [ˈpɜːmənəntli] 美 [ˈpɜːrmənəntli] adv. 永久地,长期不变地 3. involve(考研超高频词)

v. 包含,涉及,使卷入 4. prompt v. 提示,鼓励;促进;激起 adj. 敏捷的,迅速的;立刻的,及时的 5. scepticism n. 怀疑;怀疑主义 6. dampen 英 [ˈdæmpən] 美 [ˈdæmpən] v. 抑制;使…沮丧 7. desirability英 [dɪˌzaɪərəˈbɪləti] 美 [dɪˌzaɪərəˈbɪləti] n. 愿望;值得向往的事物 8. volatile 英 [ˈvɒlətaɪl] 美 [ˈvɑːlətl] adj. 不稳定的;反复无常的 9. unrestn. 不安;动荡的局面 10. capital flight 资本外逃11. balance-of-payment 收支平衡 12. soarv. 激增;高涨13. awaitv. 等候,等待14. slashv. 大幅度地削减或裁减;严厉批评15. frenetic英 [frəˈnetɪk] 美 [frəˈnetɪk]adj. 狂热的;发狂的 16. abatev. 减轻;减少;废除 17. heapv. 堆,堆积,累积

18. turmoil英 [ˈtɜːmɔɪl] 美 [ˈtɜːrmɔɪl] n. 混乱,骚动 19. aberration英 [ˌæbəˈreɪʃn] 美 [ˌæbəˈreɪʃn] n. 反常现象;偏离;行为异常的人;精神失常

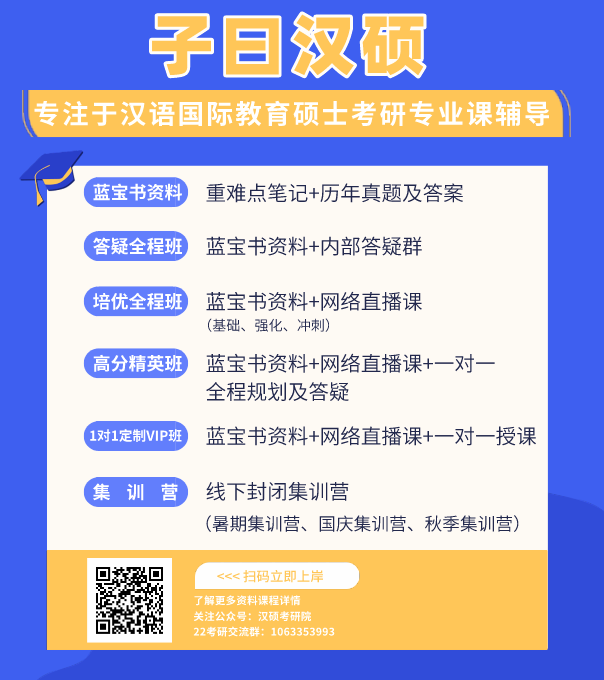

【码上添加学姐获取最新考研资讯】

微信号 :18520569495 新浪微博:@汉硕考研院 汉硕考研QQ交流群:1063353993

|

/3

/3